Page 17 - 2017-MVU-AnnualReport

P. 17

Statement of

Cash Flows

Proprietary Funds

JUNE 30, 2017

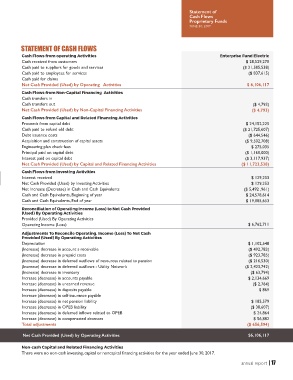

STATEMENT OF CASH FLOWS

Cash Flows from operating Activities Enterprise Fund Electric

Cash received from customers $ 28,529,270

Cash paid to suppliers for goods and services ($ 21,585,538)

Cash paid to employees for services ($ 837,615)

Cash paid for claims

Net Cash Provided (Used) by Operating Activities $ 6,106,117

Cash Flows from Non-Capital Financing Activities

Cash transfers in

Cash transfers out ($ 4,793)

Net Cash Provided (Used) by Non-Capital Financing Activities ($ 4,793)

Cash Flows from Capital and Related Financing Activities

Proceeds from capital debt $ 24,152,225

Cash paid to refund old debt ($ 21,725,607)

Debt issuance costs ($ 644,546)

Acquisition and construction of capital assets ($ 9,502,708)

Engineering plan check fees $ 275,035

Principal paid on capital debt ($ 1,160,000)

Interest paid on capital debt ($ 3,117,937)

Net Cash Provided (Used) by Capital and Related Financing Activities ($ 11,723,538)

Cash Flows from Investing Activities

Interest received $ 129,253

Net Cash Provided (Used) by Investing Activities $ 129,253

Net Increase (Decrease) in Cash and Cash Equivalents ($ 5,492 ,961)

Cash and Cash Equivalents, Beginning of year $ 24,578,614

Cash and Cash Equivalents, End of year $ 19,085,653

Reconciliation of Operating Income (Loss) to Net Cash Provided

(Used) By Operating Activities

Provided (Used) By Operating Activities

Operating Income (Loss) $ 6,762,711

Adjustments To Reconcile Operating, Income (Loss) To Net Cash

Provided (Used) By Operating Activities

Depreciation $ 1,102,548

(Increase) decrease in account s receivable ($ 492,783)

(Increase) decrease in prepaid costs ($ 923,785)

(Increase) decrease in deferred outflows of resources related to pension ($ 216,530)

(Increase) decrease in deferred outflows - Utility Network ($ 2,423,742)

(Increase) decrease in inventory ($ 63,794)

Increase (decrease) in accounts payable $ 2,134,669

Increase (decrease) in unearned revenue ($ 2,764)

Increase (decrease) in deposits payable $ 869

Increase (decrease) in self-insurance payable

Increase (decrease) in net pension liability $ 185,579

Increase (decrease) in OPEB liability ($ 38,607)

Increase (decrease) in deferred inflows related to OPEB $ 24,864

Increase (decrease) in compensated absences $ 56,882

Total adjustments ($ 656,594)

Net Cash Provided (Used) by Operating Activities $6,106,117

Non-cash Capital and Related Financing Activities

There were no non-cash investing, capital or noncapital financing activities for the year ended June 30, 2017.

annual report | 17