Page 11 - Moreno Valley Citizen's Guide to the Budget

P. 11

REVENUES SALES TAX

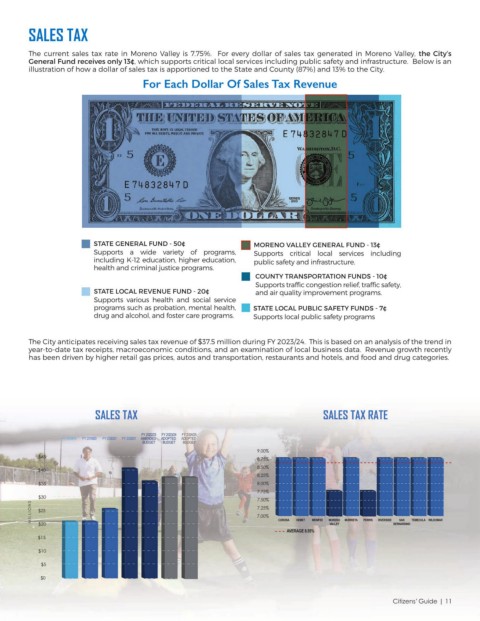

The current sales tax rate in Moreno Valley is 7.75%. For every dollar of sales tax generated in Moreno Valley, the City’s

General Fund receives only 13¢, which supports critical local services including public safety and infrastructure. Below is an

illustration of how a dollar of sales tax is apportioned to the State and County (87%) and 13% to the City.

For Each Dollar Of Sales Tax Revenue

STATE GENERAL FUND - 50¢ MORENO VALLEY GENERAL FUND - 13¢

Supports a wide variety of programs, Supports critical local services including

including K-12 education, higher education, public safety and infrastructure.

health and criminal justice programs.

COUNTY TRANSPORTATION FUNDS - 10¢

Supports traffic congestion relief, traffic safety,

STATE LOCAL REVENUE FUND - 20¢ and air quality improvement programs.

Supports various health and social service

programs such as probation, mental health, STATE LOCAL PUBLIC SAFETY FUNDS - 7¢

drug and alcohol, and foster care programs. Supports local public safety programs

The City anticipates receiving sales tax revenue of $37.5 million during FY 2023/24. This is based on an analysis of the trend in

year-to-date tax receipts, macroeconomic conditions, and an examination of local business data. Revenue growth recently

has been driven by higher retail gas prices, autos and transportation, restaurants and hotels, and food and drug categories.

SALES TAX SALES TAX RATE

FY 2022/23 FY 2023/24 FY 2024/25

FY 2018/19 FY 2019/20 FY 2020/21 FY 2020/21 AMENDED ADOPTED ADOPTED

BUDGET BUDGET BUDGET

9.00%

$45 8.75%

8.50%

$40

8.25%

$35 8.00%

7.75%

$30 7.50%

MILLIONS $25 7.25% CORONA HEMET MENIFEE MORENO MURRIETA PERRIS RIVERSIDE SAN TEMECULA WILDOMAR

7.00%

$20

AVERAGE 8.55% VALLEY BERNARDINO

$15

$10

$5

$0

Citizens’Guide | 11