Page 10 - Moreno Valley Citizen's Guide to the Budget

P. 10

REVENUES

PROPERTY TAX

The City’s FY2023/24 – 2024/25 Annual Budget addresses the priorities listed in the Momentum MoVal Strategic Plan. While

advancing these important priorities, the budget continues to reflect a strong fiscal balance that not only addresses our

community’s priorities but does so by maintaining the fiscal stewardship that earned Moreno Valley recognition as one of

the most fiscally strong cities in the nation. Property taxes are the City’s largest revenue source and are received through the

County’s allocation of taxes received. The following provides a sample of how these taxes are allocated to all public agencies.

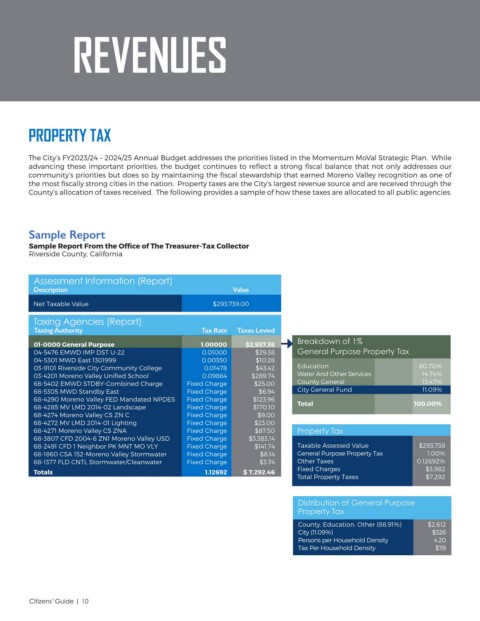

Sample Report

Sample Report From the Office of The Treasurer-Tax Collector

Riverside County, California

Assessment Information (Report)

Description Value

Net Taxable Value $293,739.00

Taxing Agencies (Report)

Taxing Authority Tax Rate Taxes Levied

01-0000 General Purpose 1.00000 $2,937.38 Breakdown of 1%

04-5476 EMWD IMP DST U-22 0.01000 $29.38 General Purpose Property Tax

04-5301 MWD East 1301999 0.00350 $10.28

03-9101 Riverside City Community College 0.01478 $43.42 Education 60.70%

03-4201 Moreno Valley Unified School 0.09864 $289.74 Water And Other Services 14.74%

68-5402 EMWD STDBY-Combined Charge Fixed Charge $25.00 County General 13.47%

68-5305 MWD Standby East Fixed Charge $6.94 City General Fund 11.09%

68-4290 Moreno Valley FED Mandated NPDES Fixed Charge $123.96 Total 100.00%

68-4285 MV LMD 2014-02 Landscape Fixed Charge $170.10

68-4274 Moreno Valley CS ZN C Fixed Charge $9.00

68-4272 MV LMD 2014-01 Lighting Fixed Charge $23.00

68-4271 Moreno Valley CS ZNA Fixed Charge $87.50 Property Tax

68-3807 CFD 2004-6 ZN1 Moreno Valley USD Fixed Charge $3,383.14

68-2491 CFD 1 Neighbor PK MNT MO VLY Fixed Charge $141.74 Taxable Assessed Value $293,738

68-1860 CSA 152-Moreno Valley Stormwater Fixed Charge $8.14 General Purpose Property Tax 1.00%

68-1377 FLD CNTL Stormwater/Cleanwater Fixed Charge $3.74 Other Taxes 0.12692%

Totals 1.12692 $ 7,292.46 Fixed Charges $3,982

Total Property Taxes $7,292

Distribution of General Purpose

Property Tax

County, Education. Other (88.91%) $2,612

City (11.09%) $326

Persons per Household Density 4.20

Tax Per Household Density $78

Citizens’Guide | 10